Nepal's EV Boom

The Nepali car market is dominated by imports, with almost no domestic car production. Traditionally, Indian brands like Tata and Maruti Suzuki, as well as Korean brands such as Hyundai and Kia, have led the way in affordable and mid-range segments. The market is characterized by significant price sensitivity, and there’s a clear divide between lower, middle, and luxury tiers with most buyers opting for budget-friendly vehicles. The automotive sector is also a huge contributor to government revenue, as vehicle import duties and sales taxes are major sources of fiscal income.

Now, coming to the electric vehicle scene: Nepal is quietly making global headlines as one of the world’s most electrified auto markets. In the past year, an astonishing 76% of all new passenger cars sold in Nepal were electric, far surpassing the global average of around 20–25%. This ranks Nepal among the world’s top countries for EV adoption. EV imports (cars, jeeps, and vans) hit nearly 11,700 units in 2023–24, up from just 1,805 in 2021–22, a huge surge fueled by government policies, tax breaks, and abundant, cheap hydroelectric power. Half of all new light commercial vehicles sold vans, minibuses, pickups are also now electric.

This EV revolution is powered by reduced import taxes on electric vehicles, aggressive government targets (like 90% of private cars and 60% of public vehicles to be electric by 2030), a rapidly expanding charging network, and ongoing public enthusiasm for cleaner, cheaper transport. Despite Nepal’s small overall car market, its embrace of electric vehicles has made it a standout example in the global push for green mobility.

China Domination in Nepal

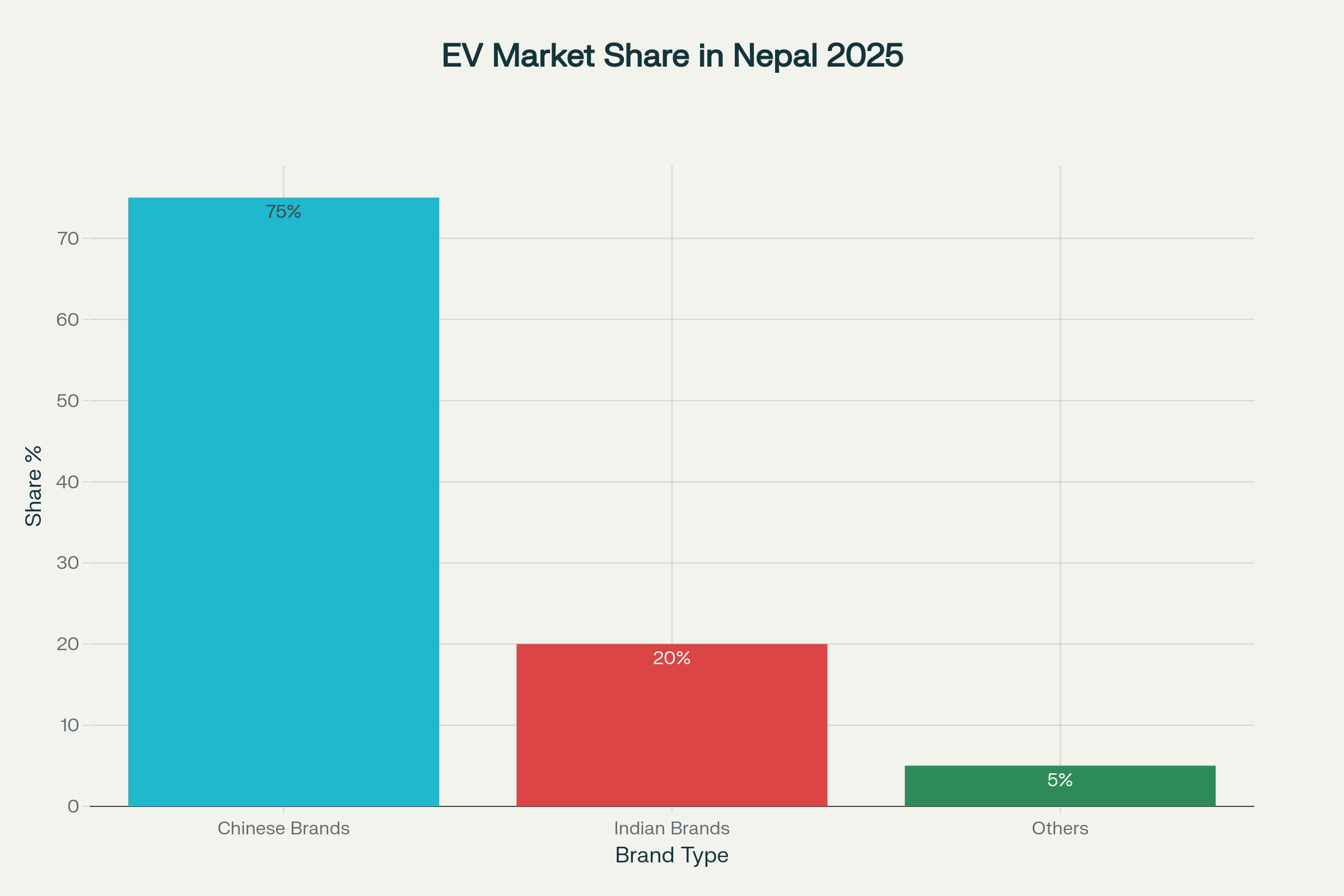

Walk down any main street in Kathmandu, and it feels like you’ve strolled into a showroom for BYD, Neta, MG, and new-wave Chinese EV brands you might not have even heard of yet. The numbers? Eye-popping. In the last fiscal year, 70% to 80% of all electric vehicles (cars, SUVs, vans) imported into Nepal came from China. China isn’t just providing shiny cars they’ve practically swept Indian makers out of Nepal’s fast-growing market. BYD alone is looking to move 4,000 cars this year, and Neta is a fresh favorite among city drivers with models like the V50 and X.

It’s not all about passenger cars, either. You’ll spot electric minibuses, vans, and even public buses rolling out of Chinese factories and onto Nepal’s mountain highways. Last year, out of 11,701 EV four-wheelers imported, 8,065 were from China a whopping 72% share. Add up everything from entry-level crossovers to flashy new SUVs, and Chinese makers raked in over Rs 34.2 billion from Nepalese buyers, dwarfing the Indian share by nearly four to one.

What’s fueling all this? Simple: value. Chinese EVs look and feel high-end, pack a ton of tech, and still cost less than the competition even before you add Nepal’s cheap hydroelectricity into the equation. Charging takes minutes, running costs are low, and the after-sales scene is booming thanks to dozens of new showrooms and service centers. Kathmandu alone has seen 18 BYD outlets pop up in just a couple years.

How Indian Car Giants Lost Their Grip: The Story of Nepal's Electric Love Affair with China

Just a few years ago, Indian cars were everywhere on Nepal’s roads. Open borders, cultural ties, and decades of dominance made Tata and Mahindra household names. But then came the electric mobility revolution and everything flipped.

Nepal, sitting on 85% hydropower, was desperate to end its reliance on imported fuel (almost all from India) and clear up its infamous Kathmandu smog. The government slashed import duties on electric vehicles and set out tough targets: 90% of private cars and 60% of public vehicles electric by 2030. The field was wide open, with no trade barriers to favor India or China.

And that’s when the Chinese car companies BYD, Neta, MG, Xpeng pounced. They flooded the market with affordable, feature-packed EVs, boasting advanced tech (ADAS, big batteries, 360° cameras, the works). By comparison, Indian carmakers lagged few models, limited tech, and smaller production scale. While Tata’s Nexon EV had its moment, China’s sheer variety and value left it in the dust.

The numbers say it all: in 2025, Chinese EVs grabbed up to 70% (some say 76%) of Nepal’s new electric car sales, pushing India’s share down to a historic low. The Chinese brands delivered what Nepali consumers wanted tech, range, and wallet-friendly prices even after duties. And with more Nepali dealers signing up Chinese brands, showroom floors went from Indian red to Chinese blue overnight.

Indian brands continued to do well with traditional fuel cars at home, thanks to protectionist policies. But in “neutral turf” Nepal, with a level playing field, the verdict was clear the Chinese EV wave washed Indian automakers off the map.

Comments

Post a Comment